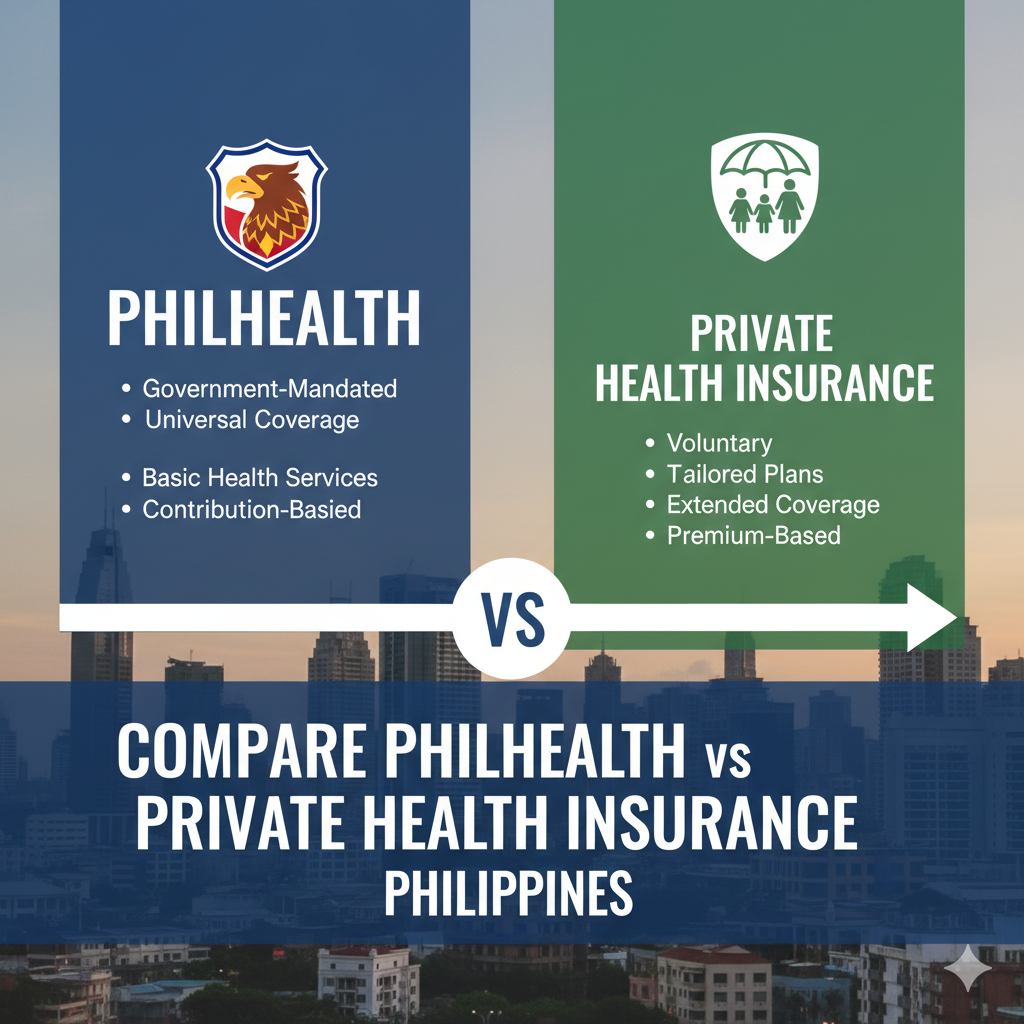

PhilHealth vs Private Health Cover

Choosing the right health protection matters. If you’re deciding between government support and a private plan, this guide will help you compare PhilHealth vs private health insurance philippines in plain language so you can make a smart choice.

Many Filipinos use PhilHealth plus an HMO or private plan — but those options behave very differently when it comes to limits, claims, and speed of service. Below you’ll get a clear side-by-side, real-world tips, and quick FAQs to make the decision easier when you compare PhilHealth vs private health insurance philippines.

This article condenses official rules, recent updates, and practical user-facing differences so you can act with confidence when you compare PhilHealth vs private health insurance philippines in 2025.

Quick snapshot (one-line comparison)

-

PhilHealth: Government social health insurer — pays case-rates to accredited hospitals for covered procedures; compulsory for many members and subsidized for indigents. PhilHealth

-

Private (HMO/Insurer): Commercial plans (HMOs, indemnity/private insurers, international plans) that add outpatient, higher inpatient limits, elective surgeries, and faster claims — but with premiums, limits, and waiting periods. inlife.com.ph+1

What PhilHealth actually covers (short)

PhilHealth pays hospitals using predefined case rates for many inpatient procedures and select outpatient packages; these case rates are listed publicly and were adjusted in recent circulars to better match costs. PhilHealth’s 2025 contribution and benefit updates aim to expand coverage but operate within a case-rate model (facility receives payment; member’s remaining bill may be reduced depending on hospital billing policy). PhilHealth+1

Key recent fact: PhilHealth updated contribution rules for 2025 (new tables and contribution guidance were issued for direct contributors). PhilHealth

What private plans (HMO vs private insurer) cover

-

HMOs — prepaid network plans that usually include routine outpatient consults, diagnostics, and in-patient benefits if you use network hospitals; they require pre-authorization and are licensed/regulated by the Insurance Commission. HMOs are often employer-sponsored but individual plans exist. Insurance Commission+1

-

Private insurers (indemnity/medical plans) — payback or reimburse actual billed amounts (subject to limits), can include lump-sum benefits, higher annual/lifetime limits, riders for critical illness, and international coverage (at higher premiums). inlife.com.ph

Cost & value: which is cheaper / better?

-

PhilHealth is low-cost (contribution-based), mandatory for many workers, and improves financial protection for many standard procedures, but its payments may not cover full private hospital bills for complex cases. PhilHealth

-

Private/HMO plans have premiums that vary widely (age, plan type, sum insured). They often deliver faster access, better accommodation options, and outpatient coverage that PhilHealth doesn’t routinely reimburse. Use private cover when you want predictable cashflow and broader benefits.

Claims, speed & user experience

-

PhilHealth claims are processed as case payments to hospitals, and implementation varies by facility (some hospitals still apply balances or request deposits). Recent PhilHealth circulars push for better implementation and adherence to no co-payment rules for covered services. PhilHealth+1

-

Private plans/HMOs usually require pre-authorization for admissions and can often settle bills directly with hospitals in their network, resulting in faster discharge and fewer out-of-pocket fronting.

When to rely on PhilHealth — and when to add private cover

-

Rely on PhilHealth for baseline financial protection, emergencies, and standard inpatient care in accredited facilities. It’s a crucial safety net. PhilHealth

-

Add private/HMO if you need outpatient benefits, shorter waiting times, access to specific private hospitals, international coverage, or higher financial limits for major illnesses.

Practical checklist before you buy (quick)

-

Check PhilHealth membership status & latest contribution table (are you up to date?). PhilHealth

-

For HMOs: confirm network hospitals, pre-auth process, and room accommodation rules. maxicare.com.ph

-

For insurers: check annual/lifetime limits, exclusions, waiting periods, and whether pre-existing conditions are covered. inlife.com.ph

FAQs (short)

Q: Can PhilHealth be my only health cover?

A: For many Filipinos PhilHealth provides essential inpatient protection, but for better outpatient care, quicker access to private hospitals, and higher limits, adding an HMO or private plan is common. PhilHealth+1

Q: Are HMOs and private insurers regulated?

A: Yes — HMOs and private insurers operate under Insurance Commission oversight and must follow IC circulars and licensing rules. Insurance Commission

Q: Will PhilHealth stop me from using private insurance?

A: No. PhilHealth can complement private plans; many use both — PhilHealth pays its share while private/HMO covers the rest as allowed by each policy. PhilHealth+1

SEO notes (quick, actionable)

-

Target keyword (exact phrase): compare PhilHealth vs private health insurance philippines — use in intro (done), in a mid-article comparison sentence (done), and in conclusion 3× (done) to satisfy your exact brief.

-

Suggested supporting keywords (LSI): PhilHealth 2025 contributions, HMO vs health insurance Philippines, PhilHealth coverage case rates, best HMO Philippines.

-

Suggested meta title (under 60 chars): PhilHealth vs Private Health Cover — Philippines Guide

-

Suggested meta description (under 160 chars): Quick, up-to-date comparison of PhilHealth and private (HMO/insurer) plans in the Philippines — benefits, costs, claims and which to choose.

Conclusion (1 paragraph — keyword appears 3× here, as requested)

When you compare PhilHealth vs private health insurance philippines, remember PhilHealth is the baseline safety net while private/HMO plans buy speed, outpatient access, and higher limits. To make the best choice, compare PhilHealth vs private health insurance philippines side-by-side for the same hospital scenario (ask for sample bills and benefit tables) and then decide whether to top up. Ultimately, when Filipinos compare PhilHealth vs private health insurance philippines, most find the ideal protection is a smart combination: PhilHealth for the core case-rate cover and a private plan/HMO to fill gaps and reduce out-of-pocket risk.